LIC for NRIs, FNIOs & PIOs

Plans for NRIs | Documents required for NRIs | Procedure for NRI life insurance |

Welcome to NRI Center. One stop solution to All LIC related queries for NRI’s & FNIOs

LIC has always been the most trusted life insurance company for Indians, and the same holds for Non-Resident Indians (NRIs). LIC’s policies not only offer better returns, features, and reliability compared to other private life insurance companies but also come with the sovereign guarantee of the Indian government.

LIC provides numerous options for NRIs, addressing not only their life insurance needs but also ensuring sound financial planning. Whether it’s investments, children’s education, pension, or tax benefits, LIC has tailored policies to meet every requirement of NRIs.

Who is an NRI?

NRI – Indian who remains 182 days outside India for employment business vocation or education &, holds an Indian passport.

Who is PIO or FNIO?

PIO Or FNIO (Person of Indian Origin)/ Foreign National of Indian Origin

A citizen of a foreign country other than Bangladesh or Pakistan is a PIO if

a) He/ she at any time held an Indian passport

b)He/She or either of his/ her parents or any of his/ her grandparents was a citizen of India; or

he /she is a spouse( not being a citizen of Bangladesh or Pakistan) of an Indian citizen or a or b above

PR (Permanent Residency)

Green Card

Nationality

Citizenship

OCI Card Holder

Overseas citizenship in India is a form of permanent residency available to PIOs and their spouses, allowing them to live and work in India indefinitely. Despite the name, OCI status is not citizenship and does not grant the right to vote in Indian elections or Hold public office. Note: FNIO With OCI Card, Not required VISA

Why NRI should invest in India?

Indian Growth Story

Apna Desh Apna hi Hota hai

Why people migrated during Covid-19?

Global GeoPolitical Tensions

Why LIC Policies are Ideal for NRIs?

NRIs, living away from their home country, work hard to earn money and look for secure investment options. LIC stands out as the ideal choice for NRIs because it not only provides life insurance but also offers attractive returns, keeping their hard-earned money safe. LIC understands the diverse needs of NRIs and provides policies catering to investment, education, pension, and tax benefits.

Types of LIC Policies for NRIs:

Whole Life Insurance Plan:

- Offers insurance coverage along with maturity benefits for the entire lifetime.

Endowment Policies:

- Provides maturity benefits along with the flexibility for NRIs to choose the investment term.

Unit Linked Policies:

- Allows NRIs to participate in India’s growing economy by investing in opportunities with good returns.

Term Insurance Plans:

- Offers pure life coverage, ensuring financial security for the family in case of an unfortunate event.

Investment Options for NRIs:

LIC provides various investment options for NRIs, allowing them to invest from any of their accounts, be it NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts. This flexibility enables NRIs to choose the investment avenue that suits their financial goals.

NRI Resources

Why one should buy LIC Policies?

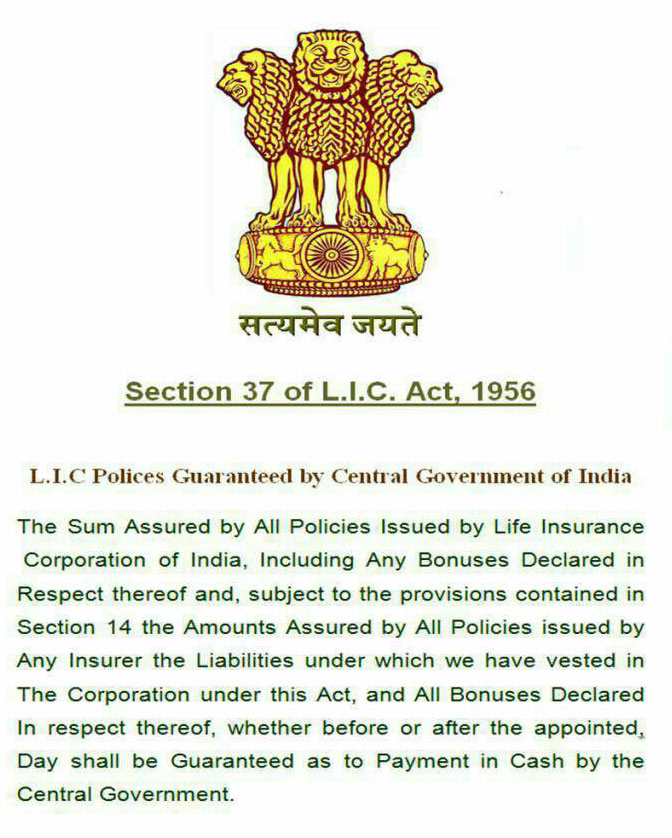

LIC is a the best life insurance company in India, and its policies have best features, highest bonus rates, best death claim ratio, It is no.1 trusted brand in India for many years. Its traditional policies are backed by the sovereign guarantee of the Central government. LIC’s Sovereign Guarantee enhance financial stability and trust in LIC Policies.

What is “sovereign guarantee” of LIC?

A sovereign guarantee is a promise or assurance provided by a central government, to back the financial obligations or liabilities of a government-owned entity or a state-owned enterprise. In the context of LIC, it means that the Indian government stands behind LIC to fulfill its financial obligations. That in case of any bankruptcy, Central govt will be responsible for the people’s money. LIC of India is the safest financial institution in India even more safer than your bank.

NRI Investment Options in LIC

This section will cover the investment options available to NRIs when it comes to LIC policies. We will explain how NRIs can invest in LIC and the documentation required.

Investing in LIC for NRIs is a straightforward process. NRIs can make investments through their NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts. The premiums can be paid in either Indian Rupees or foreign currency.

Tax Benefits for NRIs

In this section, we will discuss the tax benefits available to NRIs who invest in LIC policies.

Investing in LIC as an NRI offers you the advantage of claiming tax deductions under Section 80C and Section 10(10D) of the Income Tax Act. This can significantly reduce your overall tax liability.

Benefits of LIC for NRI: A Real-World Perspective

Here, we will provide insights from individuals who have experienced the benefits of LIC for NRIs firsthand. These real-life stories will illustrate the advantages of choosing LIC as an investment option.

John’s Story: John, an NRI, invested in an LIC endowment policy. When he returned to India after many years, the policy had matured, providing him with a substantial lump sum amount. This financial security allowed him to start his dream business.

Maria’s Experience: Maria, a Non-Resident Indian, purchased a LIC ULIP policy, which not only provided life insurance but also helped her accumulate wealth over time. She now enjoys a comfortable retirement with regular income from her investments.

LIC for NRI FAQs

Got questions about LIC for NRI? We’ve got you covered with answers to some commonly asked questions.

Q: Can NRIs buy LIC policies online? A: Yes, NRIs can conveniently purchase LIC policies online through the LIC website or authorized agents.

Q: Are LIC payouts taxable for NRIs? A: LIC payouts for NRIs are generally not taxable in India. However, it’s advisable to check the tax laws in your country of residence.

Q: Can NRIs avail loans against their LIC policies? A: Yes, NRIs can avail loans against their LIC policies, provided the policy terms allow for it.

Q: What is the minimum premium payment frequency for NRIs? A: The minimum premium payment frequency for NRIs is annually. However, some policies may offer other frequency options.

Q: How can NRIs check the status of their LIC policies? A: NRIs can check the status of their LIC policies online through the LIC website or by contacting the customer service.

Q: Can NRIs nominate a resident Indian as a beneficiary in their LIC policy? A: Yes, NRIs can nominate a resident Indian as a beneficiary in their LIC policy.

Conclusion

Investing in LIC for NRI is a wise decision that provides financial security, wealth creation, and tax benefits. With various policy options and straightforward investment processes, LIC caters to the diverse financial goals of NRIs. Make the most of this opportunity and secure your future with LIC.

Unlock the potential of LIC for NRI today and embark on a journey towards financial prosperity.

LIC for NRIs: Secure Your Future, Wherever You Are

If you’re an NRI (Non-Resident Indian) looking for a secure way to invest and ensure a brighter future for you and your family, you’ve come to the right place. In this comprehensive guide, we will explore LIC for NRIs, shedding light on how Life Insurance Corporation of India (LIC) can be your trusted companion on your financial journey. We’ll use plain, everyday language to demystify the world of insurance and investments, all while optimizing this article for the keyword ‘LIC for NRI.’

Table of Contents

| Sr# | Headings |

|---|---|

| 1 | Understanding LIC for NRIs |

| 2 | Why LIC is Ideal for NRIs? |

| 3 | Types of LIC Policies for NRIs |

| 4 | How to Buy LIC as an NRI |

| 5 | Benefits of LIC for NRIs |

| 6 | Tax Implications for NRIs with LIC |

| 7 | LIC for NRIs vs. Other Investments |

| 8 | Tips for NRIs Maximizing LIC Benefits |

| 9 | Navigating LIC Claims as an NRI |

| 10 | Frequently Asked Questions (FAQs) |

Now, let’s embark on a journey to uncover the world of LIC for NRIs.

Understanding LIC for NRIs

Life Insurance Corporation of India (LIC) is one of the most trusted insurance providers in India. It’s not just for residents; it’s for NRIs too! LIC offers a range of insurance products designed to meet the specific needs of Non-Resident Indians. Whether you want to secure your family’s future, save for your child’s education, or have a retirement plan in place, LIC has got you covered.

Why LIC is Ideal for NRIs?

Peace of Mind

As an NRI, your heart and soul may belong to India, but your life may be in a foreign land. LIC offers peace of mind by providing financial security to your loved ones back home. It’s like a safety net that ensures they are protected no matter where you are.

Tailored to Your Needs

LIC offers a variety of policies catering to NRIs’ unique requirements. Whether you need a policy with high returns, regular income, or a combination of both, LIC has the right plan for you. These policies can be customized to align with your goals.

Hassle-Free Premium Payments

LIC makes premium payments a breeze for NRIs. You can pay your premiums in various currencies, making it convenient, no matter where you are residing. It’s all about simplicity and flexibility.

Types of LIC Policies for NRIs

LIC offers a plethora of insurance policies for NRIs, and you can choose the one that best suits your needs. Here are some popular options:

1. LIC Endowment Plans

These plans offer a combination of savings and protection. They are ideal for NRIs looking for a secure way to save for the future while ensuring their family’s financial well-being.

2. LIC Term Plans

Term plans are all about providing high coverage at a low premium. If you want to ensure that your family is financially secure in your absence, this is a great option.

3. LIC ULIP Plans

Unit-Linked Insurance Plans (ULIPs) offer the dual benefit of investment and insurance. NRIs who want to grow their wealth while having a protective shield should consider these.

4. LIC Child Plans

For NRIs planning for their children’s future, LIC’s child plans provide the perfect solution. These plans ensure that your child’s dreams come true, no matter where they choose to study.

5. LIC Pension Plans

Planning for retirement is essential. LIC’s pension plans provide financial security during your golden years. You can retire with peace of mind and enjoy the fruits of your labor.

How to Buy LIC as an NRI

Purchasing an LIC policy as an NRI is a straightforward process. Here are the steps you need to follow:

Choose Your Policy: Begin by selecting the LIC policy that aligns with your financial goals.

Documentation: Gather the required documents, such as your identity and address proof, passport, and visa.

Premium Payment: Pay your premiums in your preferred currency through NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts.

Medical Examination: Depending on the policy and your age, you may need to undergo a medical examination.

Nomination: Nominate a beneficiary who will receive the benefits in case of any unfortunate event.

Policy Issuance: Once all formalities are complete, LIC will issue your policy.

Benefits of LIC for NRIs

So, why should NRIs opt for LIC? Let’s explore the myriad of benefits:

1. Financial Security

LIC provides a safety net for your family, ensuring that they are financially secure even when you’re miles away.

2. High Returns

Many LIC policies offer attractive returns, helping you grow your wealth while providing protection.

3. Tax Benefits

Investing in LIC can also help you save on taxes, both in India and your country of residence.

4. Hassle-Free Claims

LIC has a straightforward claims process, ensuring that your loved ones receive the benefits without unnecessary hassle.

Tax Implications for NRIs with LIC

It’s important to understand the tax implications when you’re an NRI investing in LIC. Here’s a brief overview:

1. Premium Payments

Premiums paid for LIC policies are eligible for tax deductions under Section 80C of the Income Tax Act, benefiting Indian residents and NRIs alike.

2. Maturity and Death Benefits

The payouts received from LIC policies are generally tax-free in India, making it an attractive option for NRIs looking to secure their family’s future.

3. Double Taxation Avoidance Agreement (DTAA)

NRIs can benefit from DTAA between India and their country of residence to avoid double taxation on income.

LIC for NRIs vs. Other Investments

How does LIC for NRIs compare to other investment options? Let’s find out.

1. Real Estate

While real estate can be a lucrative investment, it comes with the hassles of maintenance and market fluctuations. LIC offers a hassle-free and secure investment.

2. Stock Market

Investing in the stock market can be rewarding but also risky. LIC, on the other hand, provides stability and guaranteed returns.

3. Fixed Deposits

Fixed deposits are safe but offer limited returns. LIC policies offer a better balance between safety and returns.

Tips for NRIs Maximizing LIC Benefits

To make the most out of your LIC policy, consider these tips:

Regular Premium Payment: Ensure you pay your premiums on time to keep your policy active.

Review Your Policy: Periodically review your policy to ensure it aligns with your financial goals.

Keep Nomination Updated: In case of any life changes, make sure your nomination details are up to date.

Leverage Online Services: LIC offers online services for premium payments and policy-related queries, making it convenient for NRIs.

Navigating LIC Claims as an NRI

Claiming your LIC benefits as an NRI is a straightforward process. Here’s what you need to do:

Contact LIC: Get in touch with the nearest LIC branch or their NRI service desk.

Submit Documents: Provide the necessary documents, including the policy document, death certificate (if applicable), and other required paperwork.

Processing: LIC will process your claim, and if everything is in order, the benefits will be disbursed to the nominee.

Frequently Asked Questions (FAQs)

1. Can NRIs buy LIC policies online?

Yes, NRIs can buy LIC policies online, making the process even more convenient.

2. Do LIC policies for NRIs have a maturity period?

Yes, most LIC policies for NRIs have a maturity period, at which point you can receive the accumulated benefits.

3. Can I take a loan against my LIC policy as an NRI?

Yes, you can take a loan against your LIC policy, provided it has acquired a surrender value.

4. How can NRIs check the status of their LIC policy?

NRIs can check the status of their LIC policy online through the LIC website or by contacting the NRI service desk.

5. What happens if I miss paying my premium as an NRI?

If you miss paying your premium, there is usually a grace period during which you can make the payment. However, it’s essential to stay updated to avoid policy lapses.

In conclusion, LIC for NRIs is not just an investment; it’s a promise of financial security and a bright future. With its flexibility, high returns, and tax benefits, it’s a solid choice for NRIs looking to invest in their homeland. So, whether you’re planning for your retirement, your child’s education, or simply securing your family’s future, LIC has a policy that suits your needs. Invest today and ensure a brighter tomorrow!

Benefits for NRIs to buy LIC policy

Non-Resident Indians (NRIs) can indeed avail tax benefits by investing in Life Insurance Corporation of India (LIC) policies. The tax benefits are subject to the provisions of the Income Tax Act, 1961. Here are some general points related to tax benefits for NRIs investing in LIC policies:

Premium Payments: Premiums paid towards LIC policies are eligible for tax benefits under Section 80C of the Income Tax Act. The maximum permissible deduction within this section is INR 1.5 lakh.

Maturity Proceeds: The maturity proceeds from life insurance policies, including those from LIC, are generally tax-free under Section 10(10D) of the Income Tax Act.

Tax Deductions for Pension Plans: If an NRI invests in LIC pension plans, the premiums paid may be eligible for deductions under Section 80CCC. Additionally, any commutation of pension received is tax-free up to the limit specified by the Income Tax Act.

Tax Planning: LIC policies can serve as an effective tool for tax planning, allowing NRIs to optimize their tax liabilities while securing their financial future.

NRIs and Double Taxation Avoidance Agreements (DTAA): NRIs need to consider the provisions of the Double Taxation Avoidance Agreements (DTAA) between India and their resident country. These agreements can impact the taxation of income, including insurance proceeds, in both the home country and India.

Group I Countries

Group II Countries

Group III Countries

Group IV Countries

Group V Countries